Feie Calculator Can Be Fun For Everyone

Not known Incorrect Statements About Feie Calculator

Table of ContentsNot known Details About Feie Calculator All About Feie CalculatorNot known Facts About Feie CalculatorFeie Calculator - QuestionsThe Main Principles Of Feie Calculator Getting My Feie Calculator To WorkThe Of Feie Calculator

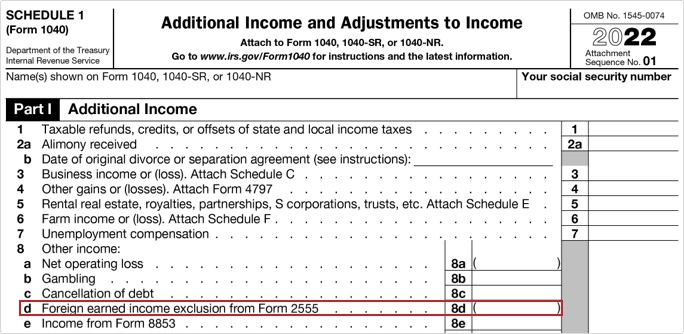

If he 'd often taken a trip, he would certainly instead finish Component III, providing the 12-month duration he satisfied the Physical Existence Test and his traveling history. Step 3: Reporting Foreign Revenue (Part IV): Mark made 4,500 per month (54,000 yearly).Mark calculates the currency exchange rate (e.g., 1 EUR = 1.10 USD) and converts his wage (54,000 1.10 = $59,400). Because he resided in Germany all year, the portion of time he stayed abroad throughout the tax obligation is 100% and he goes into $59,400 as his FEIE. Mark reports total wages on his Form 1040 and goes into the FEIE as a negative amount on Schedule 1, Line 8d, minimizing his taxable revenue.

Choosing the FEIE when it's not the best option: The FEIE might not be optimal if you have a high unearned revenue, make greater than the exclusion limit, or reside in a high-tax nation where the Foreign Tax Credit Score (FTC) may be a lot more useful. The Foreign Tax Obligation Credit Scores (FTC) is a tax obligation decrease method frequently utilized combined with the FEIE.

Feie Calculator - Truths

deportees to offset their united state tax obligation financial obligation with international revenue tax obligations paid on a dollar-for-dollar reduction basis. This implies that in high-tax countries, the FTC can frequently eliminate united state tax debt completely. However, the FTC has restrictions on qualified taxes and the maximum case amount: Qualified tax obligations: Only revenue taxes (or tax obligations instead of revenue taxes) paid to international federal governments are eligible.

tax obligation liability on your international revenue. If the foreign taxes you paid surpass this restriction, the excess international tax obligation can typically be lugged ahead for as much as 10 years or lugged back one year (using a changed return). Keeping exact records of foreign revenue and tax obligations paid is for that reason vital to determining the proper FTC and keeping tax obligation conformity.

expatriates to reduce their tax liabilities. For instance, if a united state taxpayer has $250,000 in foreign-earned income, they can exclude approximately $130,000 utilizing the FEIE (2025 ). The staying $120,000 may after that undergo taxation, but the united state taxpayer can potentially use the Foreign Tax obligation Credit score to offset the tax obligations paid to the international country.

Some Ideas on Feie Calculator You Should Know

He marketed his United state home to establish his intent to live abroad completely and applied for a Mexican residency visa with his spouse to help meet the Bona Fide Residency Examination. Neil points out that buying residential property abroad can be challenging without very first experiencing the area.

"It's something that people need to be really thorough concerning," he states, and advises deportees to be cautious of common mistakes, such as overstaying in the U.S.

Neil is careful to mindful to Stress and anxiety tax authorities that "I'm not conducting any carrying out any kind of Service. The U.S. is one of the couple of nations that tax obligations its people no matter of where they live, implying that even if a deportee has no revenue from U.S.

The Facts About Feie Calculator Revealed

tax return. "The Foreign Tax Credit score permits people functioning in high-tax nations like the UK to offset their U.S. tax obligation liability by the quantity they have actually already paid in tax obligations abroad," claims Lewis.

The possibility of lower living costs can be appealing, however it frequently features compromises that aren't quickly apparent - https://243453048.hs-sites-na2.com/blog/feiecalcu. Housing, as an example, can be much more budget friendly official site in some countries, but this can suggest endangering on facilities, safety and security, or accessibility to reputable utilities and services. Affordable residential or commercial properties could be found in locations with irregular web, limited public transport, or undependable health care facilitiesfactors that can substantially affect your day-to-day life

Below are a few of the most regularly asked questions regarding the FEIE and other exemptions The International Earned Income Exemption (FEIE) permits U.S. taxpayers to exclude up to $130,000 of foreign-earned revenue from government income tax obligation, lowering their united state tax obligation responsibility. To receive FEIE, you need to satisfy either the Physical Visibility Test (330 days abroad) or the Bona Fide Home Test (prove your main home in an international nation for an entire tax obligation year).

The Physical Existence Test also needs U.S. taxpayers to have both a foreign earnings and an international tax obligation home.

About Feie Calculator

A revenue tax treaty between the U.S. and another nation can assist avoid double taxation. While the Foreign Earned Earnings Exclusion lowers gross income, a treaty might provide additional advantages for eligible taxpayers abroad. FBAR (Foreign Financial Institution Account Report) is a required declare U.S. citizens with over $10,000 in international monetary accounts.

The international gained earnings exemptions, often referred to as the Sec. 911 exclusions, leave out tax obligation on salaries earned from functioning abroad. The exclusions comprise 2 components - a revenue exclusion and a real estate exclusion. The following Frequently asked questions talk about the advantage of the exemptions consisting of when both spouses are expats in a basic way.

Feie Calculator Fundamentals Explained

The tax obligation advantage omits the earnings from tax at bottom tax prices. Formerly, the exclusions "came off the top" decreasing revenue subject to tax at the top tax rates.

These exclusions do not spare the incomes from United States taxation however just offer a tax reduction. Keep in mind that a bachelor working abroad for every one of 2025 that gained about $145,000 without various other earnings will certainly have gross income reduced to absolutely no - properly the exact same answer as being "tax free." The exclusions are computed on a daily basis.

If you participated in service meetings or workshops in the United States while living abroad, earnings for those days can not be omitted. For United States tax it does not matter where you keep your funds - you are taxable on your globally earnings as a United States individual.